Supplemental Guide For Federal Contractors

Supplemental Guide for Federal Contractors | Current as of September, 2017

1.0 E-Verify Federal Contractor Rule Overview

1.1 Background

A presidential executive order and subsequent Federal Acquisition Regulation (FAR) rule required federal contractors to use E-Verify to electronically verify the employment eligibility of employees working under covered federal contracts. The order and rule reinforce federal government policy that the federal government does business only with organizations that have a legal workforce.

1.1.1 Executive Order 12989

On June 11, 2008, President George W. Bush amended Executive Order 12989 to direct all federal departments and agencies to require contractors to use an electronic employment eligibility verification system to verify the employment eligibility of employees performing work under a covered federal contract. The U.S. Department of Homeland Security (DHS) designated E-Verify as the electronic employment eligibility verification system that all federal contractors must use as required by the amended Executive Order 12989.

1.1.2 The E-Verify Federal Contractor Rule

On November 14, 2008, the Civilian Agency Acquisition Council and the Defense Acquisition Regulations Council published a Federal Acquisition Regulation (FAR) final rule (FAR case 2007-013, Employment Eligibility Verification) that implements the amended Executive Order 12989. The FAR is a set of rules and regulations used to manage the way the federal government acquires supplies and services with appropriated funds.

The FAR final rule, known as the E-Verify federal contractor rule, directs federal agencies to require many federal contractors to use E-Verify to electronically verify the employment eligibility of certain employees. It requires federal contractors, through language inserted into their federal contracts, to agree to use E-Verify to confirm the employment eligibility of all persons they hire during a contract term, as well as their current employees who perform work under a federal contract within the United States. The rule’s requirements to include language on E-Verify in federal contracts took effect on September 8, 2009.

IMPORTANT: If your federal contract does not have an E-Verify FAR clause, you are prohibited from using E-Verify on current employees who perform work under the contract.

1.1.3 About E-Verify

E-Verify is a free, Internet-based system operated by the U.S. Department of Homeland Security (DHS) in partnership with the Social Security Administration (SSA) that allows participating employers to electronically verify their employees’ employment eligibility. Results are returned online within seconds.

E-Verify is the best means available to determine the employment eligibility of new hires. E-Verify is currently available in all 50 states, the District of Columbia, Puerto Rico, Guam and the U.S. Virgin Islands.

More than 96 percent of E-Verify verification cases receive a case result of ‘Employment Authorized.’ Employees who receive an initial mismatch with a case result of ‘SSA or DHS Tentative Nonconfirmation (Mismatch)’ have the right to take action to resolve the case result and must be allowed to continue working during this process. A federal contractor may not refuse to assign an employee to work on a federal contract or remove an employee from working on a federal contract while the employee is taking action to resolve the case result. Additionally, a federal contractor may not take any other adverse action such as delaying training, changing shifts or withholding wages, related to a mismatch while the employee takes action to resolve the case. A federal contractor that takes any adverse action against an employee while taking action to resolve the case violates the E-Verify memorandum of understanding (MOU) and may be subject to civil penalties, back pay and other remedies under the anti-discrimination provision of the Immigration and Nationality Act, 8 U.S.C. § 1324b, or Title VII of the Civil Rights Act of 1964, and may lose access to E-Verify.

1.2 How to Determine Whether You are affected by the rule

The E-Verify federal contractor rule only affects federal contractors who are awarded a new contract on or after the effective date of the rule, September 8, 2009, that includes the Federal Acquisition Regulation (FAR) E-Verify clause (73 FR 67704). Some existing federal contracts may also be bilaterally modified to include the FAR E‑Verify clause after the effective date of the rule. For more information, see Section 5.3.

Your government contracting official, not the E-Verify program, determines whether your federal contract will include the FAR E-Verify clause. You should review your contract for the FAR E-Verify clause, and check with your government contracting official if you have questions.

1.3 The Federal Acquisition Regulation (FAR) E-Verify clause in a Federal Contract

Only federal contracts awarded and solicitations issued after September 8, 2009, will include the Federal Acquisition Regulation (FAR) E-Verify clause that requires federal contractors to use E-Verify. Your government contracting official will determine whether your contract qualifies for the FAR E-Verify clause, based on the criteria below. Subcontracts for more than $3,500 for most commercial or non-commercial services or construction also qualify for the FAR E-Verify clause.

For information on the FAR E-Verify clause, see Section 5.

1.4 Designating your organization as a federal contractor with the Federal Acquisition Regulation (FAR) E-Verify clause

If you determine that you have a federal contract that contains the FAR E-Verify clause, you must change your organization designation to ‘Federal Contractor with the FAR E-Verify Clause.’ To do this, you must update your company profile using the ‘Edit Company Profile’ link found on the left navigation menu.

Only users who choose ‘Federal Contractor with FAR E-Verify Clause’ are permitted to verify existing employees. Federal contractors with more than one federal contract may verify only those existing employees working on a contract that contains the FAR E-Verify clause unless they choose at registration or when updating their company profile, An employer that does not hold a qualifying federal contract that selectively verifies its existing employees on the basis of citizenship or immigration status or national origin may be found to have violated the anti-discrimination provision of the Immigration and Nationality Act, 8 U.S.C. § 1324b, or Title VII of the Civil Rights Act of 1964.

Federal contractors with the FAR E-Verify clause may also choose to verify their entire workforce, which includes all existing company employees regardless of whether they are assigned to a federal contract, unless those employees are exempt from being run through E-Verify. For more information on exempt employees, see Section 3.3.

Most federal contractors with the FAR E-Verify clause will select from the following two options:

- All new hires and all existing employees assigned to a federal contract, or

- Entire workforce (all new hires and all existing employees throughout the entire company)

Federal contractors that are institutions of higher learning, state or local governments, federally recognized Indian tribes or sureties performing under a takeover agreement entered into with a federal agency under a performance bond will select from the following three options:

- Employees assigned to a covered federal contract only, or

- Employees assigned to a covered federal contract and new hires throughout the organization, or

- Entire workforce (all new hires and all existing employees throughout the entire company)

For information on enrolling in E-Verify or making this selection in E-Verify, see Sections 3, 4, 8 and 9. Additionally, the ‘E-Verify User Manual’ is available from the ‘View Essential Resources link’ from the left navigation menu.

1.5 How to provide proof of enrollment in E-Verify

Federal contractors that are subject to the Federal Acquisition Regulation (FAR) E‑Verify clause may be asked to provide proof of enrollment in E-Verify. To provide proof, access the ‘Edit Company Profile’ link on the left navigation menu and print the screen containing your company information. This page contains proof of your enrollment in E-Verify.

2.0 Instructions for verifying new and existing employees on Forms I-9

2.1 Verifying New Employees using Form I-9

Newly hired employees must complete Form I-9, regardless of whether they are assigned to a federal contract. Employers must comply with Form I-9, Employment Eligibility Verification procedures found in the ‘Handbook for Employers: Instructions for Completing Form I-9 (M-274)’ which is found in the ‘View Essential Resources’ link on the left navigation menu. As an E-Verify employer, you also have additional employment verification requirements for Form I-9 that other employers do not have:

- If an employee chooses to present a List B document, you may only accept a List B document that contains a photo (if your employee cannot provide such a document because of religious objections, contact the E-Verify Contact Center at 888-464-4218).

- If an employee chooses to present an Employment Authorization Document (Form I-766), Permanent Resident Card (Form I-551) or U.S. Passport or Passport Card you must make a copy the document and retain it with the employee’s Form I-9.

- Your employees must have a Social Security number (SSN) to be verified using E‑Verify. If an employee has applied for but has not yet received his or her Social Security number (i.e., if he or she is a newly arrived immigrant), make a note on the employee’s Form I-9 and set it aside. The employee should be allowed to continue to work. Once the employee receives a Social Security number, you can create a case in E-Verify using the employee’s Social Security number as soon as the Social Security number is available.

To create a case in E-Verify, enter the information from the employee’s completed Form I-9. For detailed information and guidelines on using E-Verify, refer to the ‘E‑Verify User Manual for Federal Contractors’ located in the ‘View Essential Resources’ link on the left navigation menu.

2.2 Verify Existing Employee using Form I-9

To comply with the Federal Acquisition Regulation (FAR) rule, you must verify all new hires and existing employees assigned to a covered contract. You may also choose to verify your entire workforce. First, you must decide how to verify your employees by completing three steps.

Step 1: Decide which employees you want to verify.

- Only those existing employees assigned to a covered contract as explained in Sections 3, 4, 8 and 9, or

- Your entire existing workforce.

You should consult company counsel, the director of human resources, or other appropriate personnel before making this decision. You must make your selection in E-Verify when enrolling for the first time, or if your company is already enrolled, by updating your company information using the ‘Edit Company Profile’ link on the left navigation menu. For more information on selecting which employees to verify in E‑Verify, see Section 3.

NOTE: If you choose ‘Entire Workforce’ at the time of enrollment or when updating your ‘Company Information’ page, you must verify all existing employees except those that are completely exempt from E-Verify as described in Section 3.3 of this guide. You are not permitted to change this decision once you begin verifying your existing workforce.

Step 2: Determine which existing employees are exempt or have special requirements relating to the verification process:

Verification of your employees requires that you review Form I-9 for each employee for whom you will create a case in E-Verify. You may be required to complete a new Form I-9 or update an existing Form I-9 before you create a case in E-Verify. However, some employees are exempt from the employment verification process, including Form I-9, under the E-Verify federal contractor rule.

Employees Exempt from the Form I-9 Process

Employees who were hired on or before November 6, 1986, are exempt from completing Form I-9 and cannot be verified in E-Verify. Individuals hired for employment in the Commonwealth of the Northern Mariana Islands (CNMI) on or before November 27, 2009 are also not subject to Form I-9 or verification through E-Verify.

Employees with Special Requirements Relating to the Verification Process

Although you may not be required to verify certain employees in E-Verify, you must still comply with Form I-9 regulations. For more information on updating Form I-9, review the ‘Handbook for Employers: Instructions for Completing Form I-9 (M-274)’ found in the ‘View Essential Resources’ link on the left navigation menu.

Table 1: Employees with Exemptions or Special Requirements in the Verification Process

|

Employee |

Form I-9 |

E-Verify |

|---|---|---|

|

Employees previously verified in E-Verify |

There are no special Form I-9 requirements under the FAR rule for these employees. You must re-verify these employees as necessary under Form I-9 regulations. |

These employees are completely exempt and may not be re-verified in E-Verify. See Section 3.3, Figure 5. |

|

Employees who have an active confidential, secret or top secret security clearance in accordance with the National Industrial Security Program Operating Manual (NISPOM) or employees for whom background investigations have been completed and credentials issues pursuant to Homeland Security Presidential Directive-12 (HSPD-12) |

There are no special Form I-9 requirements under the FAR rule for these employees. If these individuals are new employees, they must complete Form I-9. If the individuals are existing employees, you must re-verify them as necessary under Form I‑9 regulations. |

If these employees meet the stated criteria, you are not required to verify them in E‑Verify. You may still choose to verify these employees in |

Step 3: Completing new Forms I-9 or Updating Existing Forms I-9

Decide how you will verify your existing employees’ information on their Form I-9. You may either:

- Complete new Forms I-9 for your existing employees, or

- Update your employees’ existing Forms I-9.

NOTE: Form I-9 Retention Whichever option you choose for step 3, you must retain any previously completed Forms I-9 for the employee. You also must make the previous forms available for inspection if it is requested by an authorized official

To assist you in making this decision, review ‘Table 2: Options for Updating Existing Employees on Form I-9.’.

Table 2: Options for Updating Existing Employees on Form I-9

| Option | Verification Process | Avoiding Liability | How This Decision Affects You |

|---|---|---|---|

| Option I:

Complete new Forms I-9 for all employees |

Complete new Forms I-9 for those existing non-exempt employees that need to be verified. The current rules for Form I-9 apply. | Verifying all non-exempt employees the same way without regard to their citizenship or immigration status or national origin helps avoid possible discrimination. | You may find this option easier because the process is the same as the process for newly hired employees. |

| Option II:

Complete new Forms I-9 when necessary and update existing Forms I-9 when allowable |

You and those employees who need to be verified must carefully examine and review their previously submitted Forms I-9 to determine:

|

To avoid possible Form I-9 violations, you must carefully determine which cases require a new Form I-9 using the guidance in Section 2.2.1. To avoid discrimination, your determination of which employees must complete or update their Forms I-9 may not be based on an employee’s citizenship status, immigration status or national origin. | This option may suit your company’s needs if you:

|

2.2.1 Instructions for option II: Complete new Form I-9 when necessary and update existing Forms I-9 when allowable

Note: This section only applies to employers who have selected Option II

If you choose to review and verify the information on existing Forms I-9 with your existing employees, there will be instances where you must complete a new Form I-9. A new Form I-9 must be completed if your employee:

- Presented an expired document on a previous Form I-9 that allowed for such documents.

- Presented an unexpired Permanent Resident Card (Form I-551) or U.S. Passport on a previous Form I-9 and that document has since expired, and his or her employment eligibility is still current, but you do not have a copy of the document.

- Is an alien whose employment eligibility as stated in Section 1 of Form I-9 has expired.

- Presented a List B document that did not have a photo when he or she completed the previous Form I-9.

- Presented a List B document on a previous Form I-9 and you are unable to determine if that document had a photo.

- Presented a document such as a Certificate of Naturalization (Form N-550 or N-570) or Temporary Resident Card (Form I-688) that was acceptable at the time of completion of the previous Form I-9, but is no longer acceptable on the latest Form I-9.

- Was at the time of attestation a noncitizen national of the United States and was unable to attest to his or her correct status in Section 1 of Form I-9 with a revision date before February 2, 2009.

- Had a change in his or her immigration status.

- Changed his or her name.

- Completed his or her previous Form I-9 and it did not comply with Form I-9 requirements at the time of completion.

NOTE: Employers must treat all employees consistently when completing Form I-9. Employers may not request more or different documents than are required to verify employment eligibility, reject genuine documents or specify certain documents over others with the purpose or intent of discriminating on the basis of citizenship status or national origin.

Instructions for updating a previously completed Form I-9:

- If your employee presented an unexpired Permanent Resident Card (Form I-551), Employment Authorization Document (Form I-766), U.S. Passport or Passport Card and it is still unexpired, make a copy of the document and retain it with the employee’s Form I-9.

- If your employee did not provide his or her Social Security number when completing a previous Form I-9, or if the employee claims that the Social Security number has changed since then, the employee should update Section 1 of the previous Form I-9 with his or her current Social Security number.

- If your employee’s Alien number has been changed by the U.S. Department of Homeland Security (DHS), the employee should update Section 1 of the previous Form I-9 with his or her current Alien number.

- If your employee presented an unexpired List B document on a previous Form I-9 and that document has since expired, you do not need to request a new version to update a previously completed Form I-9.

- If your employee presented an unexpired Permanent Resident Card (Form I-551), U.S. Passport or Passport Card on a previous Form I-9 which has since expired, his or her employment eligibility is still current, and you have a copy of the document, you may not request that the employee present an unexpired version of either document. However, as is stated in Section 2.2.1, a new Form I-9 may be completed.

Employers must treat all employees consistently when updating a previously completed Form I-9. Requesting a specific document on the basis of someone’s citizenship status or national origin may violate the anti-discrimination provision of the Immigration and Nationality Act, 8 U.S.C. § 1324b or Title VII of the Civil Rights Act of 1964 .

NOTE: Expanded document verification and error messages

E-Verify has expanded verification of Form I-9 documentation to include driver’s licenses. E-Verify may prompt you to provide additional information when an employee presents a driver’s license for Section 2 of Form I-9.

As of April 3, 2009, all documents presented by an employee for Form I-9 must be unexpired (see exception below). If you enter a document for an employee that was expired at the time the employee was hired, and the employee was hired after April 3, 2009, E-Verify will display the ‘Error: Unexpired Document Required’ screen. This means that E-Verify has NOT created a case for this employee; you must obtain an unexpired document for Form I-9 and re-enter the case. This error message applies to U.S. Passports and Passport Cards as well as driver’s licenses and ID cards issued by a U.S. state or outlying possession.

An expired document does not mean that the employee is not authorized to work in the United States. E-Verify will confirm the employment eligibility of this employee once you obtain an unexpired document and re-enter the case.

Exception: In very limited situations, you may accept an expired document with Form I-9 only if the Department of Homeland Security (DHS) has automatically extended the expiration date of the document via publication in the Federal Register. In all other instances, the document presented with Form I-9 must be unexpired at the time the worker is referred. For information on this exception, visit www.uscis.gov/tps

REMINDER: Employers may not specify or request which Form I-9 documentation an employee must use.

For more information, see the ‘E-Verify User Manual for Federal Contractors’ and the ‘Handbook for Employers: Instructions for Completing Form I-9 (M-274).’

3.0 E-Verify enrollment and participation as a federal contractor with the Federal Acquisition Regulation (FAR) E-Verify clause

Companies awarded a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify clause must enroll in E-Verify. This section provides an overview for enrollment and proper use of E-Verify.

3.1 Overview of E-Verify enrollment and use

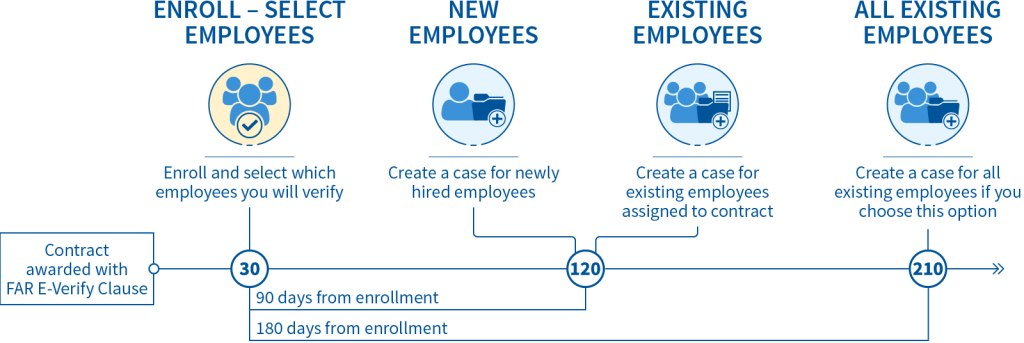

Your deadlines for creating an E-Verify case for employees depends on whether you are new to E-Verify or are already participating in the program.

3.2 Deadlines for enrollment and verifying employees

Companies New to E-Verify

If your company is not yet enrolled in E-Verify, you must:

- Enroll in E-Verify as a federal contractor with Federal Acquisition Regulation (FAR) E-Verify clause within 30 calendar days of the award date of a contract that contains the FAR E-Verify clause. For an overview of the enrollment process, see Section 8.

- Begin verifying all newly hired employees within 90 calendar days of your enrollment date unless you are an organization that qualifies for an exception as described in Section 4 of this guide.

- Create E-Verify cases for all existing employees assigned to the qualifying contract within 90 calendar days of enrolling in E-Verify or 30 calendar days of the employee’s assignment to the contract, whichever date is later.

- When E-Verify asks you which employees you will verify, the selection you make will affect the 180-day time period for verifying all existing employees. If you select ‘Entire workforce,’ you must create cases for all existing employees within 180 calendar days. If you have selected to verify your ‘Entire workforce,’ but have not yet begun verifying your existing employees, you may change your selection to ‘All new hires and all existing employees assigned to a federal contract.’ However, if you have begun verifying your existing employees then you are not permitted to change your selection. For more information, see Section 8.

Figure 3: Deadlines for New Participants with the FAR E-Verify Clause

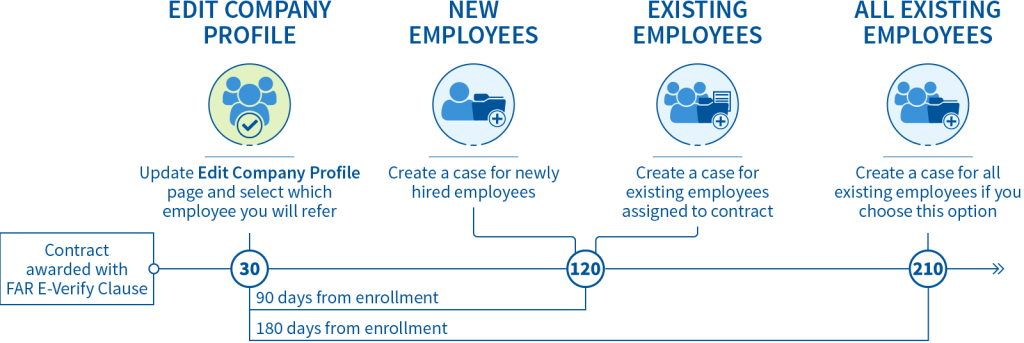

Companies Already Participating in E-Verify

If your company is already enrolled in E-Verify, but not designated as a federal contractor with FAR E-Verify clause in E-Verify, you must:

- Update your company information by selecting the ‘Edit Company Profile’ link on the left navigation menu. You must change your organization designation to ‘Federal Contractor with FAR E-Verify Clause’ within 30 calendar days of the award date of a new federal contract that contains the FAR E-Verify clause. For more information, see Section 9. Do not re-enroll in E-Verify, as this will create a duplicate account in E-Verify.

- Begin using E-Verify at all of your company’s hiring sites where you will be verifying any existing employees. For more information, see Section 9.4.

- Verify new hires no later than the third business day after they start work for pay. If you are already verifying new hires under the memorandum of understanding (MOU), you must continue to do so.

- Create cases for all existing employees assigned to the qualifying contract within 90 calendar days of designating your company as a ‘Federal Contractor with FAR E-Verify Clause’ in E-Verify or 30 calendar days of the employee’s assignment to the contract, whichever date is later.

- Select the appropriate employees to verify. When E-Verify asks you which employees you will verify, the selection you make will affect the 180-day time period for verifying all existing employees. If you select ‘Entire workforce,’ you must create cases for all existing employees within 180 calendar days. If you have selected to verify your entire workforce, but have not yet begun verifying your existing employees, you may change your selection to ‘All new hires and all existing employees assigned to a Federal contract.’ However, if you have begun verifying your existing employees then you are not permitted to change your selection.

Figure 4: Deadlines for Existing E-Verify Participants

Subsequent Federal Contracts

If a company is:

- Already enrolled in E-Verify as a federal contractor with FAR E-Verify clause

and

- Receives a subsequent federal contract with the FAR E-Verify clause,

The company must continue to create cases for newly hired employees within three business days of their start date. However, the company will have 90 calendar days from the award date of the subsequent contract to create E-Verify cases for existing non-exempt employees working on the subsequent contract.

The additional 90-day period does not apply to companies that have chosen to verify their entire workforce. Companies also do not receive an additional 30 calendar days to enroll or update their company profile since they enrolled as a federal contractor with the FAR E-Verify clause when the initial federal contract with FAR E-Verify clause was awarded.

Figure 5: Federal Contractor with FAR E-Verify Clause Enrollment and Verification Deadlines

Note: Some employees are completely exempt from the E-Verify requirement, and some organizations are not required to verify all new hires. For more information, see Sections 3.3, 4 and 5.

| When do I enroll in E-Verify? | When do I verify new hires? | When do I verify existing employees assigned to a contract? | When do I verify all existing employees if I choose to do so? | |

|---|---|---|---|---|

| New E-Verify Users |

Within 30 calendar days of award or modification of a contract that contains the FAR E-Verify clause. When you enroll, select ‘Federal Contractor with FAR E-Verify Clause’ when prompted in E‑Verify. |

Begin using E-Verify to create cases for all of your new hires within 90 calendar days of enrolling in E‑Verify and selecting which employees you will verify. * Note: Consider any employees you hire before you make this selection in E-Verify to be existing employees for purposes of E-Verify. |

Create cases for all existing employees assigned to a contract within 90 calendar days of enrolling in E-Verify and selecting which employees you will verify.* OR Within 30 calendar days of the employee’s assignment to a contract, whichever date is later. |

Create cases for all existing employees, regardless of whether they are assigned to a federal contract, within 180 calendar days of enrolling in E-Verify and selecting ‘Entire Workforce’ when asked which employees you will verify.* |

|

Existing |

Do NOT re-enroll. Within 30 calendar days update your ‘Edit Company Profile’ page in |

Create cases for all of your new hires within 90 calendar days of updating your ‘Edit Company Profile’ page and selecting which employees you will verify.* Note: Consider any employees you hire before you make this selection in E-Verify to be existing employees for purposes of E-Verify. |

Create cases for all existing employees assigned to a contract within 90 calendar days of updating ‘Edit Company Profile’ page and selecting which employees you will verify. OR Within 30 calendar days of employee’s assignment to a contract, whichever date is later. |

Create cases for all existing employees, regardless of whether they are assigned to a federal contract, within 180 calendar days of selecting ‘Entire Workforce’ when updating the ‘Edit Company Profile’ page. |

*Create cases for all newly hired employees no later than the third business day after they start work for pay.

3.3 Employees who are Exempt from E-Verify

Employees exempt from E-Verify are outlined in ‘Figure 6: Employees Exempt from E‑Verify.’ You are not permitted to verify these employees in E-Verify.

In addition, ‘Figure 7: Employees That Are Not Required to be Verified’ outlines the types of employees that are not required to be verified in E-Verify, but you may choose to verify them. If you choose to verify the employees in Figure 7, you should do so for all such employees to ensure that you are not engaging in discrimination in the verification process.

Figure 6: Employees Exempt from E-Verify

| Employee: | Exempt From E‑Verify? | May I Choose To Verify This Employee? |

|---|---|---|

|

Hired on or before November 6, 1986, and continuing in employment with the same employer Note: This includes employees hired in the Commonwealth of the Northern Mariana Islands (CNMI) on or before November 27, 2009 |

Yes |

No |

|

Previously confirmed as authorized to work in E-Verify and continuing in employment with the same employer |

Yes |

No |

Figure 7: Employees That Are Not Required to Be Verified

| Employees Who: | E-Verify Required? | May I Choose To Verify This Employee? |

|---|---|---|

|

Perform support work such as general company administration or indirect or overhead functions and do not perform any substantial duties applicable to the contract. However, you must verify these employees if the employee is a new hire or if you choose to verify your entire workforce. |

No |

Yes |

|

Have an active confidential, secret or top secret security clearance in accordance with the National Industrial Security Program Operating Manual (NISPOM) or Homeland Security Presidential Directive-12 (HSPD-12) credential; a background check alone is not enough to qualify for this exemption (also exempt if new hire). Note: Transportation Worker Identification Credential (TWIC) cards do not qualify. |

No |

Yes |

Example: XYZ, Inc. hires Jane Doe, who has a top secret clearance, to work on a federal contract. XYZ still must enroll in E-Verify and use E-Verify for its other employees but is not required to use E-Verify for Jane. XYZ should note on Jane’s Form I-9 that she was exempt from E-Verify because of her security clearance. Even if every employee at XYZ has a security clearance, XYZ still must enroll in E-Verify because the E-Verify federal contractor rule contains no enrollment exception for companies whose employees all have security clearances.

NOTE: Interim clearances are based on the completion of minimum investigation requirements and are granted on a temporary basis, pending the completion of the full investigation requirement for final clearance. Therefore, interim security clearances do not exempt an employee from E-Verify if the employee is a new hire or existing employee assigned to a federal contract that contains the FAR E-Verify clause.

4.0 Certain Organizations that Qualify for Exceptions

The E-Verify federal contractor rule generally requires use of E-Verify for all new employees, regardless of whether they are assigned to a federal contract. However, the following organizations awarded a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify clause are only required to use E-Verify for new hires and existing non-exempt employees who are working directly under a covered contract:

- State and local governments

- Institutions of higher education (as defined at 20 U.S.C. 1001(a))

- Governments of federally recognized Indian tribes

- Sureties performing under a takeover agreement entered into with a federal agency under a performance bond

Example: A city government has a federal contract that includes the FAR

E-Verify clause. After the E-Verify federal contractor rule implementation date, it hired Doris to work on a contract containing the FAR E-Verify clause and hired Frank to work on a project that is not part of a federal contract. The city government need only verify new and existing employees assigned to a qualifying federal contract. Therefore, the city government must use E-Verify to verify Doris, but is not required to verify Frank. The city is not required to verify anyone else on the staff not working on the federal contract, but may choose to verify the entire staff (except for those employees who are exempt).

You must indicate that your organization qualifies for the exception when you enroll in E-Verify or, if your company is already enrolled, when you update your company profile.

Note: Your Form I-9 requirements are no different than the requirements for any other federal contractor whose contract contains the FAR E-Verify clause. For more information, see Section 2.

4.1 Your Options

You may choose which employees your organization will verify through E-Verify from the following three options:

- Employees (new and existing) assigned to a federal contract only

- Employees assigned to a covered federal contract and new hires throughout the organization

- Entire workforce (all new hires and all existing employees throughout the entire company)

Note: If you choose to verify your entire existing workforce in E-Verify, you must verify all of your existing employees except those who are completely exempt from E-Verify as discussed in Section 3.3. If you have selected to verify your entire workforce, but have not yet begun verifying your existing employees, you may change your selection to ‘All new hires and all existing employees assigned to a Federal contract.’ However, if you have begun verifying your existing employees, then you are not permitted to change your selection.

4.2 Verifying your Entire Workforce

If you choose to verify your entire workforce rather than just the employees assigned to a qualifying federal contract, you must:

- Update your organization designation to indicate that you’ve chosen to verify your company’s entire workforce (except for those employees who are exempt from E-Verify as discussed in Section 3.3) by:

- Choosing the entire workforce option during the E-Verify initial enrollment process, or

- Updating your company profile and selecting the ‘Entire Workforce’ option.

- Create cases for all existing non-exempt employees within 180 calendar days of notifying us that you’ve chosen to verify your entire workforce.

For additional instructions on enrollment, see Sections 8 and 9.

5.0 Qualifying Contracts

This section will assist you in determining whether your company has a qualifying federal contract, which existing employees are exempt from verification in E-Verify and which companies are exempt from the E-Verify federal contractor rule.

5.1 The Federal Acquisition Regulation (FAR) E-Verify Clause in a Federal Contract

You are subject to these special E-Verify rules only if your federal contract includes a written FAR E-Verify clause. Only federal contracts awarded and solicitations issued after September 8, 2009, will include the FAR E-Verify clause that requires federal contractors to use E-Verify. Your government contracting official will determine whether your contract qualifies for the FAR E-Verify clause, based on the criteria below. Subcontracts for more than $3,500 for services or construction also qualify for the FAR E-Verify clause.

If your federal contract contains the FAR E-Verify clause, subject to certain exceptions as described in the E-Verify federal contractor rule and this manual, you must use E‑Verify to confirm the employment eligibility of:

- All persons hired during a contract term, and

- Current employees who perform work under that federal contract within the United States.

To verify these individuals, you must:

- Enroll in E-Verify within 30 calendar days of the contract award date, and

- Use E-Verify to verify that all your new hires and existing employees working directly on federal contracts are authorized to work in the United States.

If your federal contract does not include the FAR E-Verify clause, you are not required to enroll in and use E-Verify as a federal contractor, but may participate voluntarily. Only federal contractors with the FAR E-Verify clause and covered subcontractors are permitted to create E-Verify cases for existing employees.

5.2 How to Determine if your Federal Contract Qualifies

Your government contracting official, not E-Verify, will decide if your federal contract qualifies for the Federal Acquisition Regulation (FAR) E-Verify clause. To qualify, the contract must meet the following criteria:

- The contract was awarded on or after the E-Verify federal contractor rule effective date of September 8, 2009, and includes the FAR E-Verify clause.

- The contract has a period of performance that is for 120 days or more.

- The contract's value exceeds $150,000;

- At least some portion of the work under the contract is performed in the United States.

If you have questions about your federal contract status under the E-Verify federal contractor rule:

- Check with your government contracting official and staff to clarify your obligations.

- Speak with your legal counsel.

5.3 Indefinite Delivery/Indefinite Quantity (IDIQ) Contract

If you have an existing IDIQ contract, your government contracting official may modify it on a bilateral basis to include the Federal Acquisition Regulation (FAR) E‑Verify clause for future orders, in accordance with FAR 1.108(d)(3), when:

- The remaining period of performance extends at least six months after the effective date of the rule, and

- The amount of work or number of orders expected under the remaining period of performance is substantial.

If the FAR E-Verify clause is included in a modification of your IDIQ contract, you must participate in E-Verify within 30 calendar days of the modification date.

5.4 Contracts exempt from the Federal Acquisition Regulation (FAR) E-Verify Federal Contractor Rule

Companies whose contracts are exempt from the E-Verify federal contractor rule are not required to enroll in E-Verify. A contract is considered exempt if any one of the following applies:

- It is for fewer than 120 days.

- It is valued at or below $150,000.

- All work is performed outside the United States.

- It includes only commercially available off-the-shelf (COTS) items and related services.

Your company may voluntarily enroll in E-Verify at any time, but you may not create cases for existing employees unless you hold a federal contract that includes the FAR E-Verify clause and are enrolled in E-Verify as a ‘Federal Contractor with the FAR E‑Verify clause.’ If your company is awarded a federal contract in the future that includes the FAR E-Verify clause, then you must enroll as a ‘Federal Contractor with the FAR E-Verify clause’ and use E-Verify at that time.

6.0 Subcontractors, Independent Contractors and Affiliates

6.1 Subcontractors

The E-Verify federal contractor rule requires certain federal prime contractors to require their subcontractors to use E-Verify when:

- The prime contract includes the Federal Acquisition Regulation (FAR) E-Verify clause;

- The subcontract is for commercial or noncommercial services or construction;

- The subcontract has a value of more than $3,500; and

- The subcontract includes work performed in the United States

Subcontractors who do not provide any services and only provide supplies under their subcontract are not subject to the E-Verify federal contractor rule.

6.2 Prime Contractor and Subcontractor Obligations

The prime contractor should provide general oversight to the subcontractors to ensure they meet the E-Verify requirement. The prime contractor is responsible for ensuring all subcontractors at every tier incorporate the Federal Acquisition Regulation (FAR) E-Verify Clause 52.222-54, Employment Eligibility Authorization. The prime contractor may be subject to fines and penalties if they knowingly continue to work with a subcontractor who is in violation of the E-Verify FAR requirement.

How can subcontractors provide proof of their E-Verify enrollment to the prime contractor? The subcontractor should give the prime contractor a copy of their Edit Company Profile page in E-Verify, which can be printed directly from E-Verify.

Prime contractors are not responsible for verifying their subcontractors’ individual employees.

The prime contractor must be enrolled in E-Verify as an E-Verify employer agent. This will allow the subcontractor to designate the prime contractor as their employer agent and ensure E-Verify compliance.

6.3 Independent Contractors and Self-Employed Individuals

Form I-9 rules govern whether an individual is considered self-employed with respect to using E-Verify. Generally, self-employed individuals are not required to complete Forms I-9 on themselves; therefore, they are not required to use E-Verify. However, all employers, including sole proprietorships, must complete Form I-9 for each employee they hire. Employers will need to confirm the employment eligibility in E‑Verify of each employee working under a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify clause.

Employers are not required to complete Forms I-9 and use E-Verify for their independent contractors. The Form I-9 regulations use common-law understandings of employer-employee relationships to describe who is an independent contractor. However, if the independent contractor is a subcontractor under a federal contract covered by the FAR E-Verify clause, the E-Verify requirement will flow down to the independent contractor, who must use E-Verify to verify its own employees.

Example: Acme Corporation enters into a federal contract that contains the FAR E-Verify clause to construct a federal building and must verify its own employees in E-Verify. Acme subcontracts with Don Draftsman, a self-employed individual, to provide some technical drawings. Acme also subcontracts with Edwards Engineering to install some equipment. Both subcontracts are for more than $3,500 and are covered by the FAR E-Verify clause. Both companies complete their work as independent businesses, perform their work according to their own means and methods, and are subject to Acme’s control for results only.

Acme cannot use E-Verify to verify either Don Draftsman’s employment eligibility or the employment eligibility of Edwards Engineering’s employees. However, Acme is responsible under the E-Verify federal contractor rule for ensuring that Edwards Engineering, as Acme’s subcontractor on a covered federal contract, enrolls in E-Verify and verifies its new hires and its covered existing employees assigned to the federal subcontract.

While Acme is also responsible for ensuring Don Draftsman’s compliance with the FAR E-Verify clause, as a self-employed individual, Don does not need to complete a Form I-9 on himself or enroll in E-Verify, nor can Acme create an E-Verify case for Don. Under the employer sanction rules applicable to any employer, Acme cannot use an independent contractor if it knows that the independent contractor is an alien who is not authorized to work in the United States.

6.4 Subsidiaries and Affiliates

Only the legal entity (business) that signs the contract is considered the federal contractor with the E-Verify clause and is bound by the E-Verify obligation.

Whether certain subsidiaries and affiliates are a part of the legal contracting entity depends on the specific factual context. Consult your legal counsel if you have additional questions about this topic.

Remember, the Federal Acquisition Regulation (FAR) does not extend to contracts under which all work is exclusively performed outside the United States. The United States territories of American Samoa and the Commonwealth of the Northern Mariana Islands are not considered part of the United States for purposes of the E-Verify federal contractor rule.

7.0 Mergers and Acquisitions

Employers who have acquired or merged with another company have two options for satisfying Form I-9 requirements for acquired employees:

Option A: Treat all acquired individuals as new hires and complete a new Form I-9 for each individual regardless of the employee’s original hire date. If you choose this option, you must complete new Forms I-9 for all of your acquired employees, without regard to actual or perceived citizenship status or national origin in order to ensure that you do not discriminate against new or existing employees. In addition, when completing new Forms I-9, you must allow all employees to choose one document from List A or a combination of one document from List B (containing a photo) plus one document from List C. You must enter the effective date of the acquisition or merger as the date the employee began employment in Section 2 of the new Form I-9.

Option B: Treat acquired individuals as employees who are continuing uninterrupted in their employment status with a reasonable expectation of employment at all times, as those concepts are defined in 8 Code of Federal Regulations (CFR) 274a.2(b)(1)(viii), and retain the previous owner’s Forms I‑9 for each employee. You are liable for any errors or omissions on the previously completed Forms I-9; therefore, you should review each Form I-9 with the employee and update or re-verify the employee’s information, as necessary. See note below for employees hired on or before November 6, 1986.

Note: Employees hired on or before November 6, 1986, who are continuing in their employment and have a reasonable expectation of employment at all times, as those concepts are defined in 8 CFR 274a.2(b)(1)(viii), are exempt from completing Form I‑9 and cannot be verified in E-Verify. If you determine that an employee hired on or before November 6, 1986 is not continuing in his or her employment or did not have a reasonable expectation of employment at all times, and is therefore a new hire, the employee may be required to complete a Form I-9. See 8 CFR 274a.2(b)(1)(viii) and 274a.7.

Individuals hired for employment in the Commonwealth of the Northern Mariana Islands (CNMI) on or before November 27, 2009 are also not subject to Form I-9 or verification through E-Verify.

For more information about how to avoid discrimination during the Form I-9 process, contact the Department of Justice, Civil Rights Division, Immigrant and Employee Rights Section (IER) at 1-800-255-8155, or visit the IER website at www.justic.gov/ier.

Mergers and acquisitions are complicated processes. Employers may find it difficult to determine whether employees acquired during a merger or acquisition are continuing in their employment or whether they are considered a new hire for Form I-9 purposes. For that reason, the U.S. Department of Homeland Security (DHS) strongly recommends that any business confronted with this question consult with its legal counsel.

Acquired Employees Become Existing Employees

Regardless of whether you choose Option A or B, if you are a federal contractor with the Federal Acquisition Regulation (FAR) E-Verify clause and the merger or acquisition took place prior to the federal contract award date, your acquired employees are considered existing employees. Federal contractors with the FAR E-Verify clause have special rules relating to the verification of existing employees.

Timelines for Verifying Employees Acquired through a Merger or Acquisition

Employers who are already using E-Verify as required by the FAR E-Verify clause, which then merge with or acquire another company, must comply with the timelines listed below for verifying employees gained through merger or acquisition.

- If you have chosen to verify your entire workforce, you will have 180 days from the effective date of the merger or acquisition to create an E-Verify case for each of the non-exempt employees acquired through a merger with or acquisition of the other company.

OR

- If you are not verifying your entire workforce, you will have 90 days from the effective date of the merger or acquisition to create an E‑Verify case for each of the non-exempt employees assigned to the contract who joined the company due to a merger with or acquisition of the other company.

Regardless of the timeline for creating cases for acquired employees, you must create cases for each newly hired employee who joins the company outside of the merger or acquisition process no later than the third business day after the employee begins work for pay.

8.0 Enrollment Instructions for Contractors not yet enrolled in E-Verify

If your company is awarded a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify clause, you must enroll in E-Verify. This section will help you enroll in E-Verify if you are a new E-Verify user that has never before enrolled.

8.1 Options for Verifying Existing Employees

At a minimum, your company must verify existing non-exempt employees who work on a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify clause. Before you enroll in E-Verify, decide whether you would like to verify:

- Only those non-exempt employees working on the federal contract with the FAR E-Verify clause. With this option, you must track which employees are assigned to a federal contract that includes the FAR E-Verify clause to ensure that you only verify those employees working on the qualifying contract. You must also track which employees have already been verified through E-Verify.

- Your entire non-exempt workforce.

8.2 Federal Contractor Enrollment Steps

When you enroll your company, you will need to tell us some basic information about your company and agree to follow the rules of our program in the memorandum of understanding (MOU).

During enrollment, you will be asked, ‘Which category best describes your organization?’ You may choose from the following categories:

- Federal Contractor with FAR E-Verify Clause

- Federal Contractor without FAR E-Verify Clause

- Federal Government

- State Government

- Local Government

If you choose ‘Federal Contractor with FAR E-Verify Clause,’ you will be able to perform functions in E-Verify that are unavailable to other users, such as verifying existing employees. However, if you choose ‘Federal Contractor without FAR E-Verify Clause’ or ‘Federal, State or Local Government,’ you must not verify existing employees. For more information on enrolling in E-Verify, please refer to the ‘E-Verify User Manual for Federal Contractors’ available at www.dhs.gov/E-Verify.

You will also be asked, ‘Which employees will your company verify?’ You will then select from the following two options:

- All new hires and all existing employees assigned to a federal contract, or

- Entire workforce (all new hires and all existing non-exempt employees throughout the entire company).

Note: If you choose to verify your entire workforce at the time of enrollment or when initially updating your ‘Edit Company Profile’ page, and you have not yet begun verifying your existing employees, you may change your selection to ‘All new hires and all existing employees assigned to a Federal contract.’ However, if you have begun verifying your existing employees, then you are not permitted to change your selection

If you choose ‘All new hires and all existing employees assigned to a Federal contract’ at the time of enrollment or when initially updating your ‘Edit Company Profile’ page, and later you choose to verify your entire workforce, you may update your ‘Edit Company Profile’ page to reflect this decision. Once you select ‘Entire Workforce,’ you are not permitted to change this decision once you begin verifying your existing employees outside a covered contract. See Section 3.2 for more information.

9.0 Federal Contractors currently enrolled in E-Verify

If your company is awarded a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify clause, you are required to use E-Verify. This section will help you to update your company profile and verification process in E-Verify if you are already enrolled.

9.1 Updating your Company Profile

Once your company is awarded a federal contract that includes the Federal Acquisition Regulation (FAR) E-Verify clause, you must designate your company as a federal contractor with the FAR E-Verify clause in E-Verify. You should not do so until you officially receive a qualifying federal contract.

If your organization is already enrolled in E-Verify, you must ensure that your company profile is updated in E-Verify. To do so:

- Log in to E-Verify as a program administrator or ask your company’s E-Verify program administrator to perform this function.

- From Company Account, select Company Profile.

- From Company Profile, click Edit Employer Category.

- When asked, ‘Which category best describes your organization?’ choose Federal Contractor and then select Federal Contractor with FAR E-Verify Clause’.

- If your company qualifies for an organizational exception, you must select None of these categories apply, even if your company also qualifies for federal contractor with FAR E-Verify clause.

- When asked, ‘Which employees will your company verify?’ choose the option that best fits your company’s needs.

- Review your company information and then click Save.

Note If you choose to verify your entire workforce at the time of enrollment or when initially updating your ‘Edit Company Profile’ page, you are not permitted to change this decision once you begin verifying your existing workforce.

If you choose ‘All new hires and all existing employees assigned to a Federal Contract’ at the time of enrollment or when initially updating your ‘Edit Company Profile’ page, and later you choose to verify your entire workforce, you may update your ‘Edit Company Profile’ page to reflect this decision. Once you select ‘Entire Workforce,’ you are not permitted to change this decision once you begin verifying your existing employees outside a covered contract.

The selection you make will affect the 180-day time period for verifying all existing employees described in Section 3.2.

9.2 Federal Contractor Tutorials

Once you have changed your company’s organization designation to ‘Federal Contractor with FAR E‑Verify Clause,’ your E-Verify program administrators and general users must successfully complete a federal contractor-specific tutorial and pass a knowledge test before they can use E-Verify again.

9.3 Memorandum of Understanding (MOU)

As a federal contractor using E-Verify, your company must comply with the federal contractor-specific terms of the E-Verify MOU. The MOU can be found at www.E-Verify.gov.

Depending on when your company enrolled in E-Verify, the MOU that your company signed may not contain the new federal contractor-specific terms. It is not necessary for you to re-enroll and sign a new MOU. However, your company is bound by the new MOU. Under the terms of your current MOU, E‑Verify reserves the right to provide you with notice of any system changes including those relating to federal contractors with the FAR E-Verify clause. E-Verify also provides training materials that contain information for users about any changes to the system.

All E-Verify-enrolled companies enrolled as a ‘Federal Contractor with FAR E-Verify clause’ must comply with the terms of the current MOU irrespective of the date when they signed their own MOU or whether the MOU signed by that company differs in any way from the current MOU available.

We strongly recommend that you review the current MOU to ensure your company complies with, and agrees to, any new terms.

9.4 Updating your Verification Process

The E-Verify federal contractor rule adds some new requirements and removes some of the flexibility that your company traditionally had in deciding how it uses E-Verify. Depending on how your company has been using E-Verify, you may need to make some changes to how you use the system. For instance, if your company has been selectively using E-Verify at certain hiring sites, but not others, you must begin using E-Verify at all of your company’s hiring sites.

Example: You only use E-Verify to verify employees at your Arizona locations. In your company profile, only your Arizona locations are listed. As a federal contractor, you must include all of your company’s hiring sites in your company profile. Also, because you must verify all of your newly hired employees with certain exceptions, you’ll no longer be able to use E-Verify on a location-by-location basis.

You do not need to wait to expand your use of E-Verify to all of your company’s hiring sites until you are awarded a federal contract that includes the FAR E-Verify clause. However, you may not sign up as a ‘Federal Contractor with FAR E-Verify clause’ or use E-Verify on current employees until you are awarded a federal contract that includes the FAR E-Verify clause.

10.0 Information for E-Verify Employer Agents

E-Verify employer agents, formerly known as designated agents, use E-Verify to confirm the employment eligibility of their clients’ employees. This section will assist E-Verify employer agents and their clients in preparing for the effects of the E-Verify federal contractor rule.

10.1 Recommended Actions for E-Verify Employer Agents

- Update E-Verify profiles

For your federal contractor clients, update each of your federal contractor client company profiles separately to designate them as a ‘Federal Contractor with FAR E-Verify Clause.’

For your own company, only update your profile to designate yourself as a federal contractor if you are a ‘Federal Contractor with FAR E-Verify Clause’ that was awarded a contract that contains the Federal Acquisition Regulation (FAR) E-Verify clause.

- Ensure that you meet the tutorial requirement

Before updating a company profile to designate ‘Federal Contractor with FAR E‑Verify Clause,’ inform the program administrators and general users that they must complete a federal contractor-specific tutorial and pass a knowledge test before accessing E-Verify again.

- Review the latest E-Verify memorandum of understanding (MOU)

All E‑Verify enrolled companies must comply with the terms of the current E‑Verify MOU, which contains federal contractor-specific terms with which both federal contractor client companies and their E-Verify employer agents must comply. Depending on when you enrolled in E-Verify, your original MOU may not contain these terms. Therefore, you should review the current MOU to ensure your company complies with the federal contractor-specific terms of the current E-Verify MOU.

10.2 Using Web Services

We are now able to support federal contractor access via Web services on Interface Control Document versions 17 and higher. All versions of Web services currently in use support the Federal Acquisition Regulation (FAR).

The Web services access method requires a company to develop software that interfaces with E-Verify to perform employment eligibility verifications of newly hired employees. Your company’s software will extract data from your existing system, or an electronic Form I-9, and transmit the information to government databases. If you choose this option, you will be sent the Employer Web services Interface Control Document. The Interface Control Document contains the information you need to develop and test your software interface.

Federal contractors using the services of a Web services E-Verify employer agent must notify the Web services E-Verify employer agent when it receives a contract with the FAR clause. The Web services E-Verify employer agent must update the client’s organization designation to ‘Federal Contractor with FAR E-Verify Clause’ in E‑Verify within 30 calendar days of the contract award.

11.0 E-Verify Resource and Contact Information

The E-Verify public website is the primary resource for all E-Verify information, but do not hesitate to contact us via phone or email. For easy access to online resources, USCIS suggests that employers bookmark or save the websites as favorites for easy access to them in the future.

E-Verify Resources

E-Verify Public Website: www.E-Verify.gov

- General information about E-Verify

- Program information and statistics

- E-Verify user manuals

- E-Verify quick reference guides

- E-Verify Questions and Answers

- Information about employee rights and employer obligations

E-Verify Enrollment Application: https://everify.uscis.gov/enroll

- Website for initial employer enrollment

E-Verify Access for Employers and Corporate Administrators: https://everify.uscis.gov/emp

- User access to E-Verify

E-Verify Access for E-Verify Employer Agents: https://everify.uscis.gov/esp

- User access to E-Verify

E-Verify Contact Information

The E-Verify Contact Center is available to assist you with using E-Verify, password resets, cases and technical support. We can also answer your questions about E-Verify policies and procedures, Form I-9 and employment eligibility. We are available Monday through Friday, from 8:00 a.m. to 8:00 p.m. Eastern time, except when the federal government is closed. For users with hearing and speech impairment, TTY phone is available from 8:00 a.m. to 8:00 p.m. Eastern time.

For E-Verify Employer Agents

For Clients

For Employees

U.S. Department of Justice, Civil Rights Division, Immigrant and Employee Rights Section (IER)

IER is available to answer your questions about immigration-related employment discrimination, including discrimination based on citizenship status, immigration status or national origin in the Form I-9 and E-Verify processes. IER can provide immediate assistance by phone through its hotlines Monday through Friday, from 9:00 a.m. to 5:00 p.m. Eastern time, except when the federal government is closed. Calls can be anonymous and language interpretation services are available.

For Employers

For Employees

Equal Employment Opportunity Commission (EEOC)

EEOC is available to answer your questions about employment discrimination, including discrimination based on race, color, religion, sex (including pregnancy), national origin, age (40 or older), disability, or genetic information.